- Date

Stable Swaps and Pools Now Live on Sushi

Swap & create pools among like-kind assets on Polygon, Optimism, Metis & Kava

- 0xGenghisGoose

We are elated to announce that the second pool type for Trident, the Stable Pool, is now live on Polygon, Optimism, Metis and Kava and is ready to be utilized! Trident is a revolutionary framework for easily launching your own pools and making your own markets, initially launching with support for a single pool type, the classic Constant Product Pool, which uses the traditional constant product formula: x * y = k. With the second type, Stable Pools, users can now trade on a different formula that is ideal for minimal price impacts between like-kind assets. You can begin creating your own Stable Pools (make sure you're connected to the right network) and making Stable Swaps on the regular swap page here.

What's A Stable Pool? A Stable Swap?

Stable Pools give users more flexibility when it comes to market making, opening up a whole new suite of possibilities. They implement a different formula, x³y + y³x = k, to allow for trades of like-kind assets (i.e. a “Stable Swap”) with a minimal price impact, generally pegged stablecoins and tokens that are directly correlated such as renBTC <> wBTC, stETH <> ETH, etc. For example, if you wanted to trade some DAI for USDC, you can make the trade from the Swap page as usual, and should receive near zero price impact in normal market conditions. This is the main issue Stable Pools and Stable Swaps are here to solve: getting our users more intuitive swapping on key assets, while also adding another fee-generating medium for those who wish to market make and earn on their own Stable Pools.

How Does It Work?

Stable Pools work by concentrating the liquidity around the price of 1 for each asset in the pool, keeping them balanced and liquid during various trading climates. For example, a user could receive 1 USDC for every 1 DAI they trade, or 1 renBTC for every 1 WBTC. This 1-1 mapping of assets not only allows for low price impact Stable Swaps, but also is an intuitive way for users to know almost exactly how much they will be receiving in their trades. In addition, since Trident is built on top of BentoBox, liquidity providers (LPs) of Stable Pools also get the added benefit of their idle capital generating passive yield for them automatically, on top of the extra yield they’re already accruing from Trident swaps via low-risk strategies. All users also get the same default added benefits from leveraging BentoBox, such as auto-convert functions for ETH / WETH and simplified token approvals, to name a few.

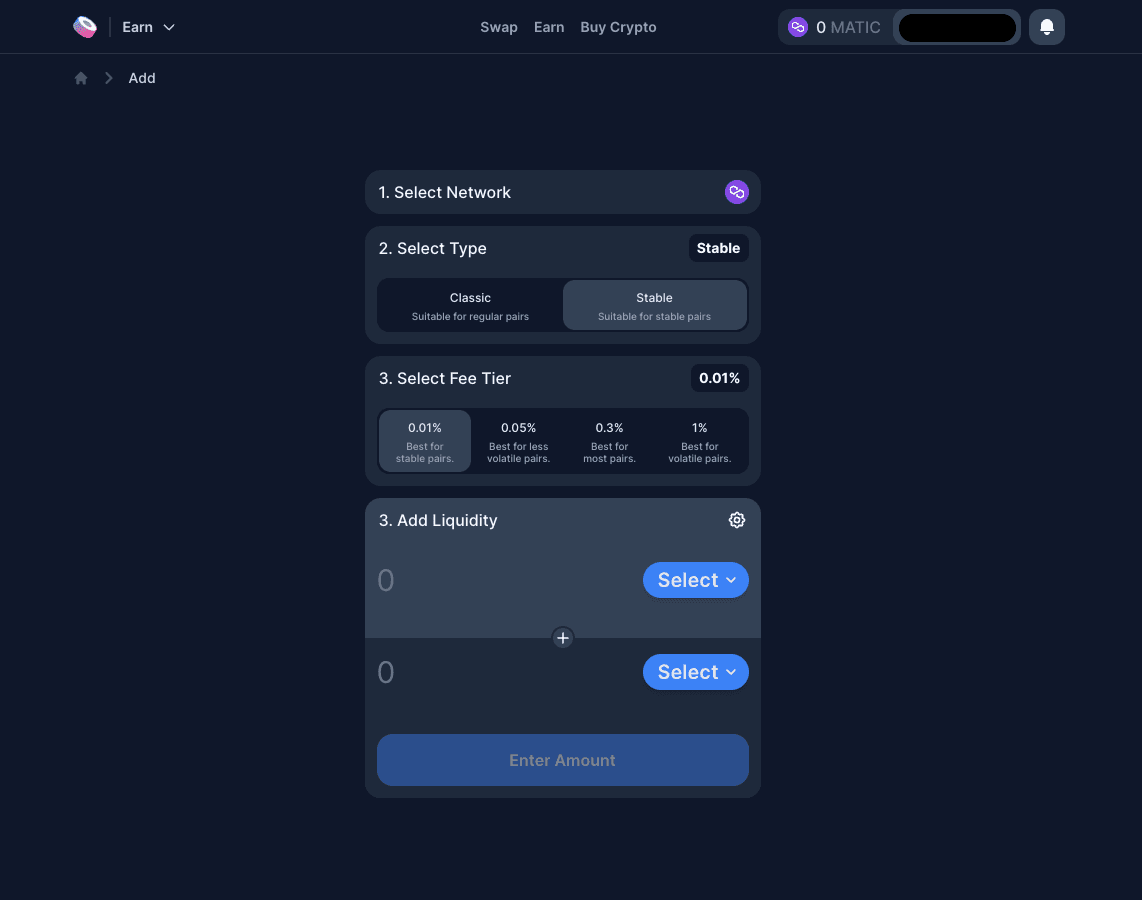

Easily swap your stables

Or create your own Stable Pool (make sure you're on the right network and select the right pool type)

We cannot wait to show the community the power of Stable Swap and Stable Pools on Sushi - let us know what you think about our new pools on Twitter or in the Discord!

Sushi is building a comprehensive DeFi ecosystem! Follow our socials to keep up with our product launches and find out more on how you can make the most of your cryptocurrency assets with Sushi’s secure and powerful DeFi tools!

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github