- Date

Maximizing Profits with Gamma Strategies on Sushi v3 Concentrated Liquidity Pool

An introduction of Gamma and a step by step walkthrough

- Mizu

Welcome to the home of DeFi: Sushi

TL;DL

- Gamma v2 is available on SushiSwap's v3 Concentrated Liquidity Pool on Polygon and Arbitrum, allowing LPs to maximize their earnings with smart strategies.

- Gamma offers different strategies like "Narrow," "Wide," and "Stable," each suited for varying risk levels and market conditions.

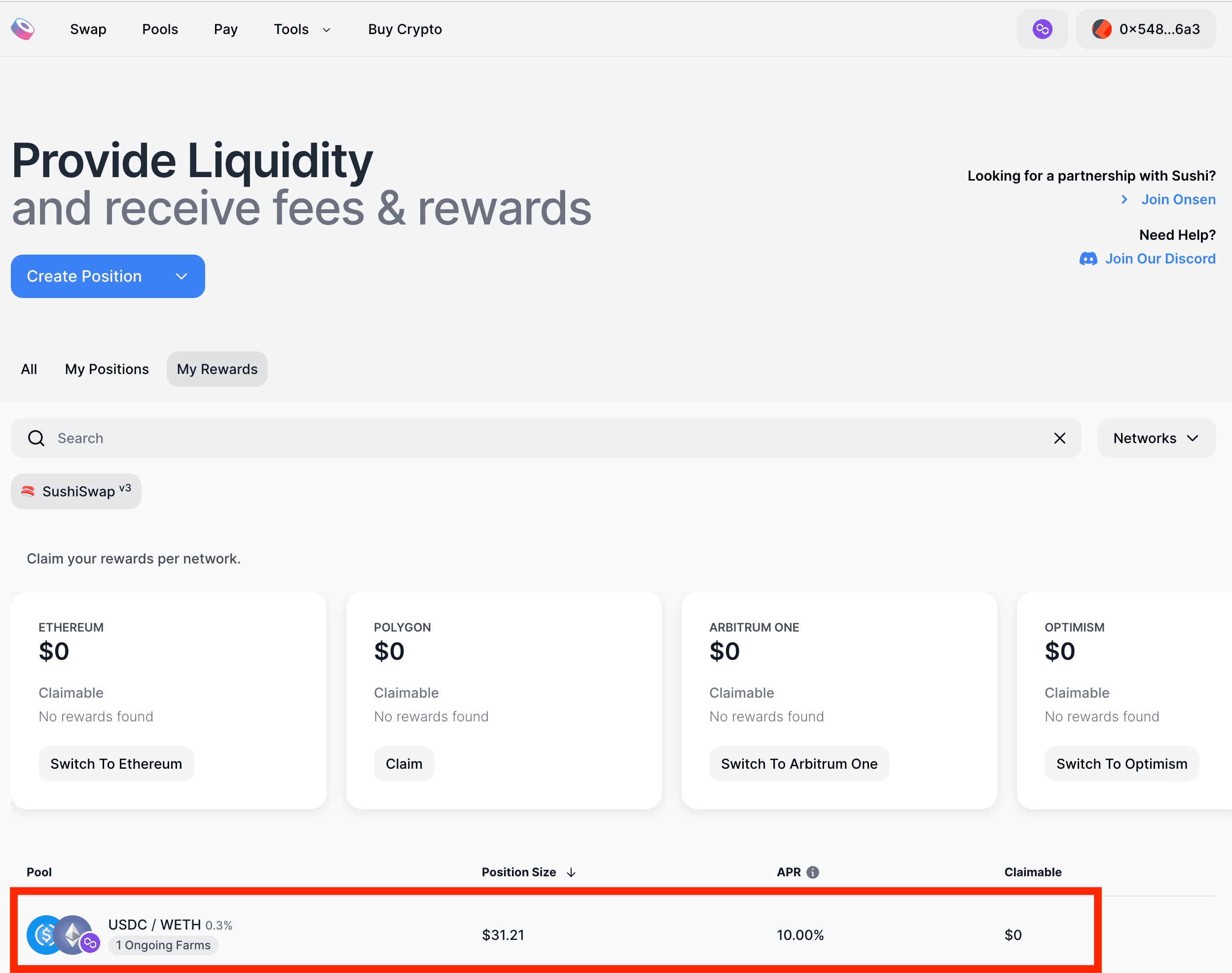

- Merkl by Angle Protocol enables LPs to claim $SUSHI rewards without staking their LP positions.

- Gamma and SushiSwap's partnership provides higher profits and lower risks for LPs. Get started now!

Gamma v2 has officially gone live on SushiSwap's v3 Concentrated Liquidity Pool, enabling liquidity providers (LPs) to maximize their earnings. With Sushi's v3 CL launch in May, LPs can now enjoy higher fees and reduced impermanent loss, although potential risks should be considered i.e.. active monitoring the market and managing the price range.

Just announced, the upgraded Gamma v2 web app offers improved UX and an analytics section for optimizing yield generation passively. Moreover, the partnership with Sushi allows LPs to earn $SUSHI rewards. Read on to explore Gamma, its benefits, and how it works on Sushi.

What is Gamma?

Gamma is a protocol designed for non-custodial, automated, and active management of concentrated liquidity. Gamma's protocol is built into a web application.

Gamma provides set of smart strategies that help LPs make the most of their assets. It automates tasks like rebalancing and compounding to optimize profits and reduce risks for LPs.

Gamma Strategies

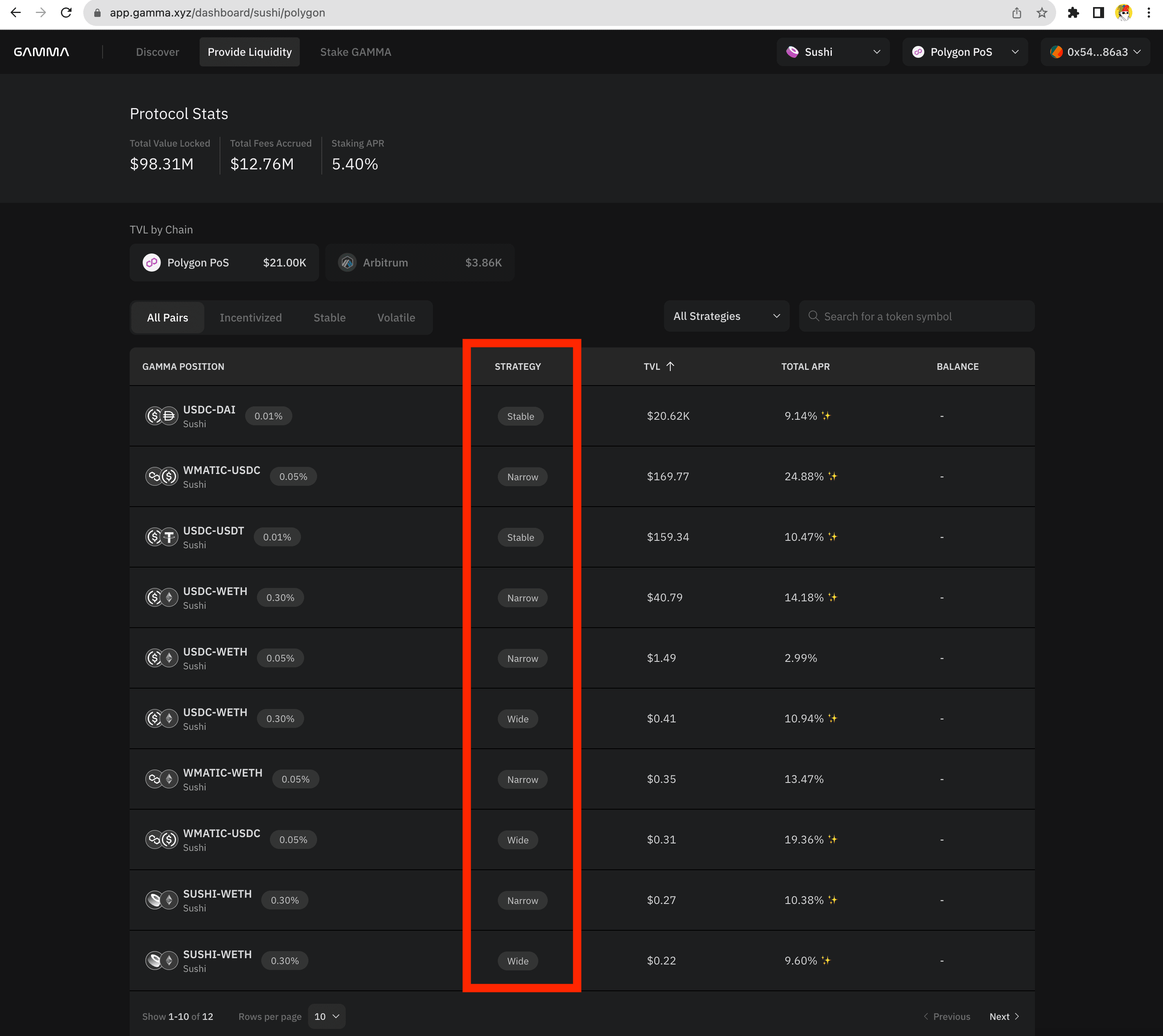

Gamma offers different approaches including Dynamic Range, Stable, Pegged Price, Advanced Hedging and Custom Strategy for various assets and risk levels, and we will focus on Dynamic Range and break down what “Narrow, Wide and Stable” refer to on this UI.

Dynamic Range automatically adjusts liquidity to fit market conditions, offering automated rebalancing of liquidity ranges based on certain triggers, providing a passive experience for liquidity providers (LPs).

Narrow:

- Suitable for short-term providers, benefiting from higher fees and rewards, but may lead to increased losses in highly volatile markets.

- Performs better in low volatility environments due to higher fee multipliers.

Wide:

- Suitable for long-term providers, considering high volatility and aiming for lower impermanent loss despite higher fees.

- More favorable in high-volatility settings, considering impermanent loss savings in the long run.

Stable:

- Ideal for stablecoin pairs, providing liquidity ranges that can be set wider or narrower based on the prevailing volatility.

- Offers a balance between short-term and long-term strategies, catering to varying risk preferences in stable market conditions.

LPs need to carefully consider their risk preferences and investment horizon to choose the most suitable strategy.

How does it work on Sushi v3?

Step-by-Step Tutorial:

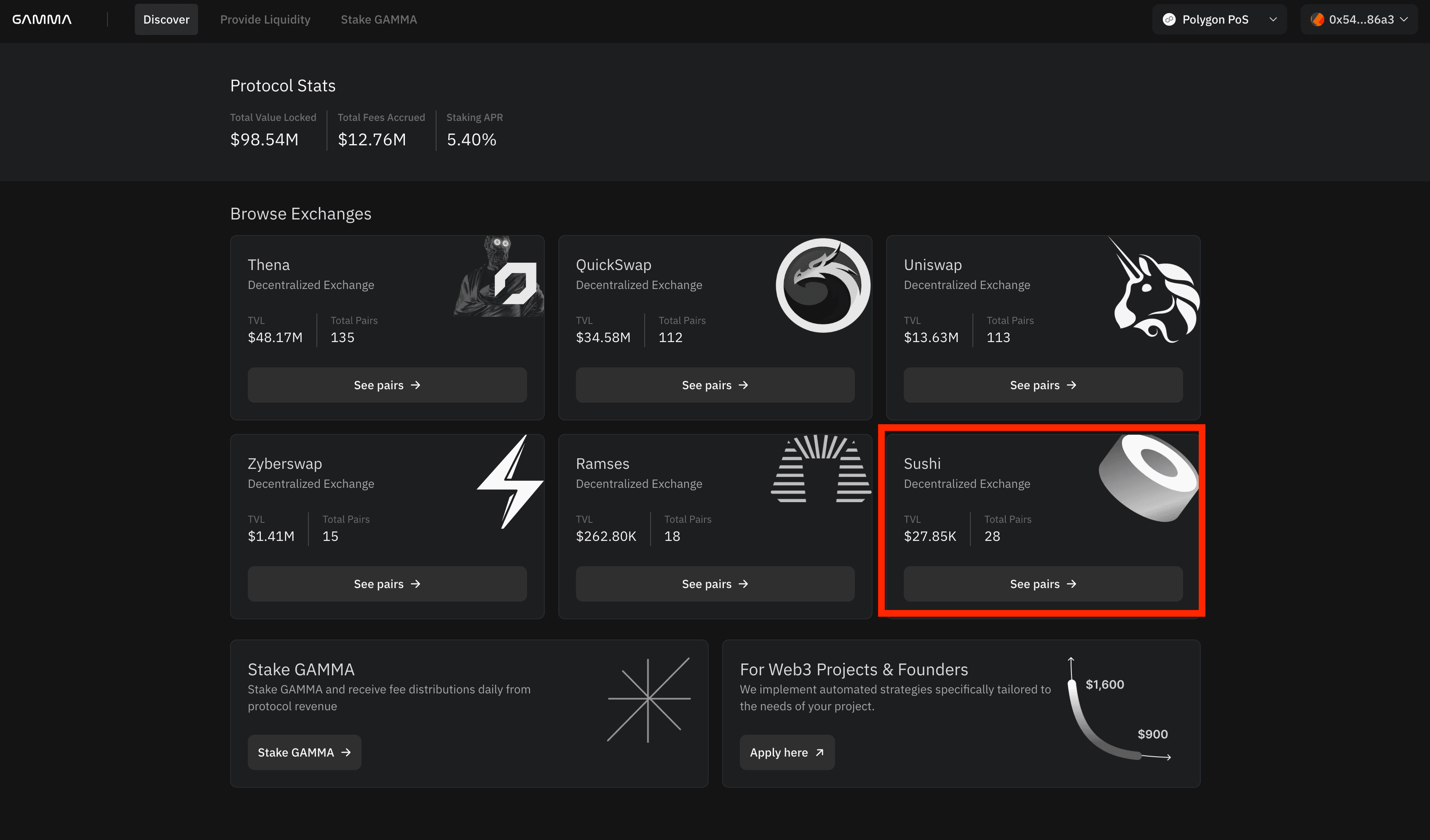

-1. Visit the Gamma website: Link

-2. Choose Sushi

-3. Connect your wallet, e.g. using MetaMask here

-4. Select a network from either Polygon or Arbitrum, as they are the two available networks.

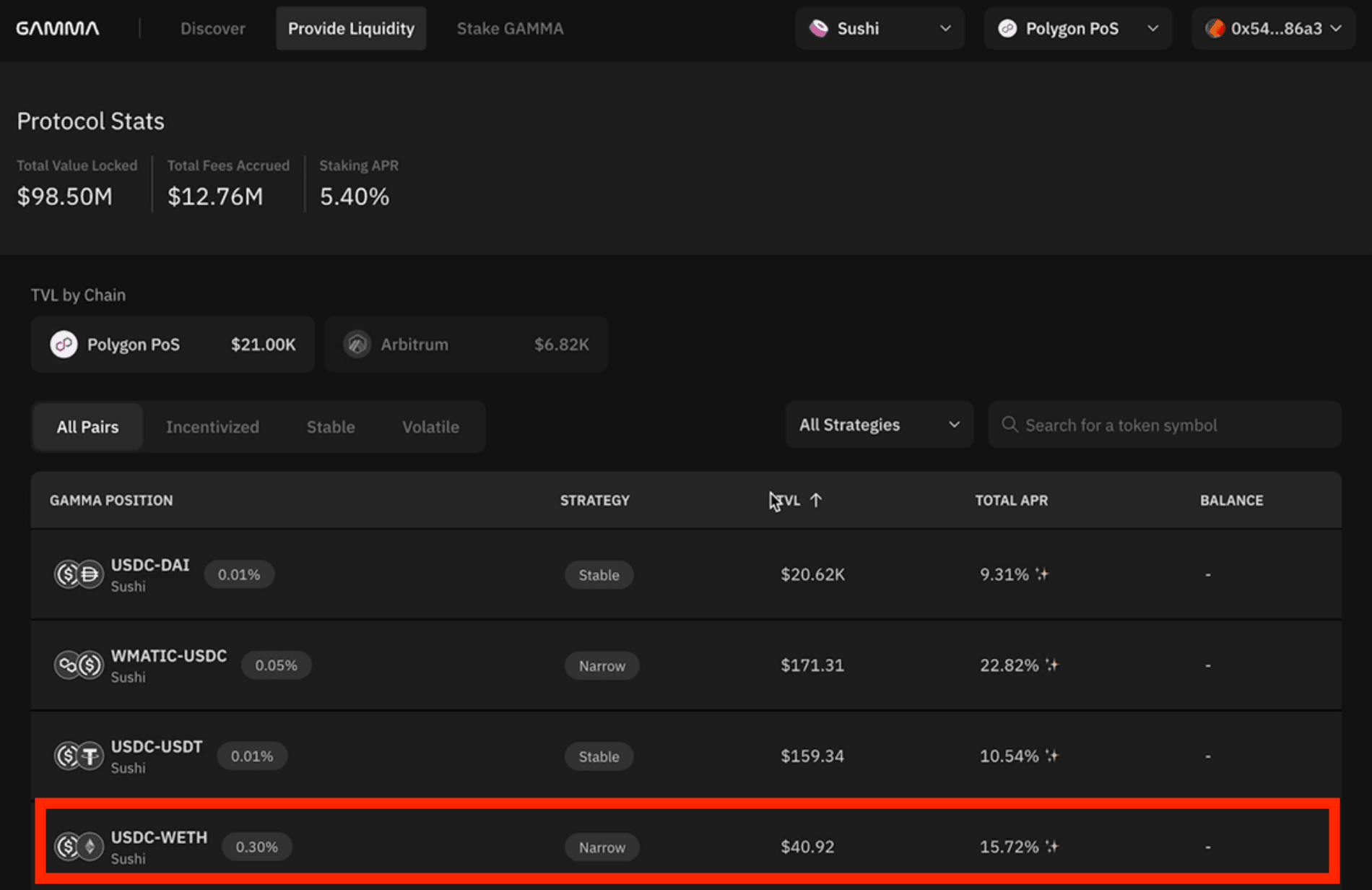

-5. Based on your investment strategy, choose a pool to participate in. Consider factors like Total Value Locked (TVL), Annual Percentage Rate (APR), and $SUSHI rewards. For example, I choose the USDC-WETH pool with a "Narrow" strategy.

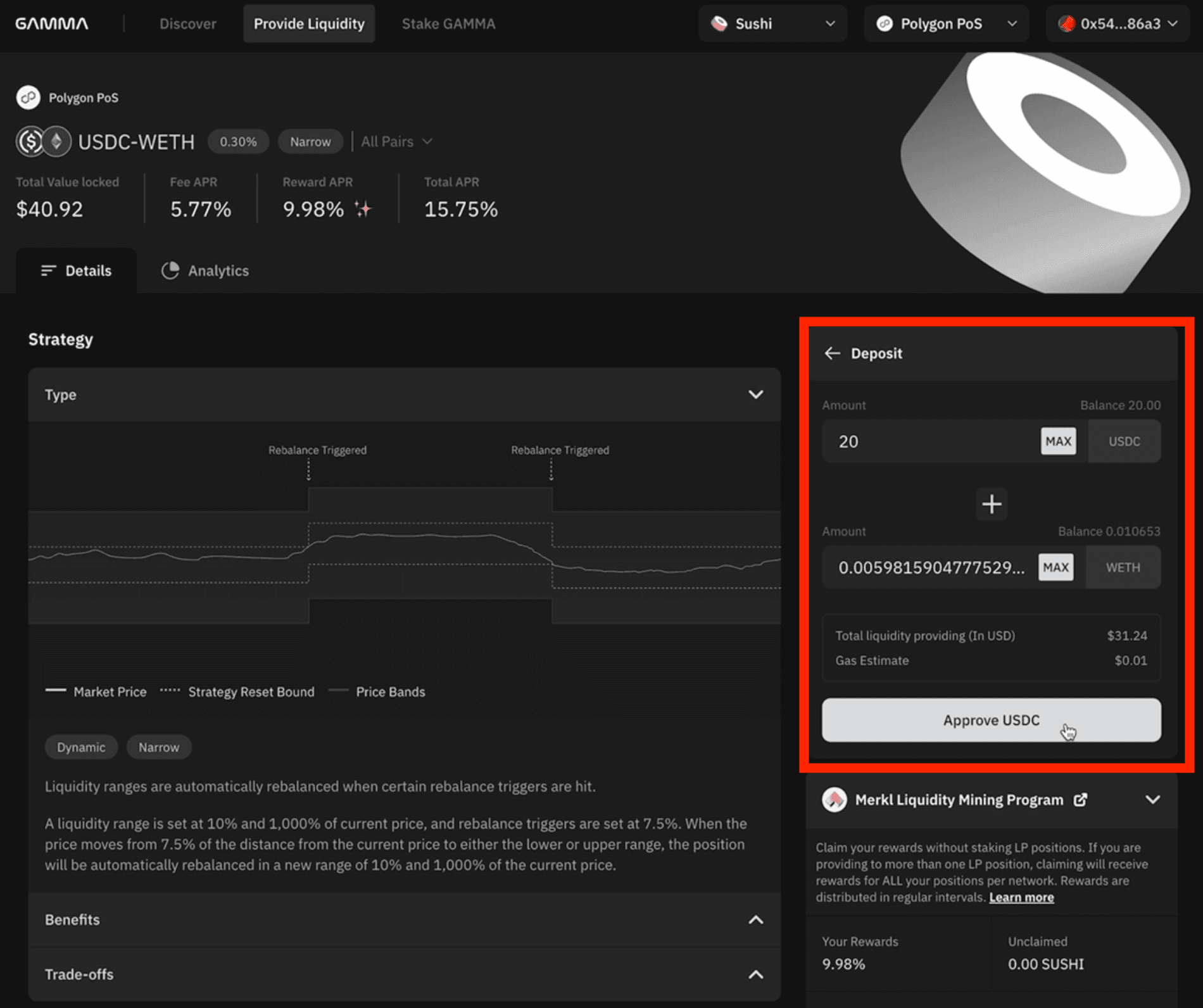

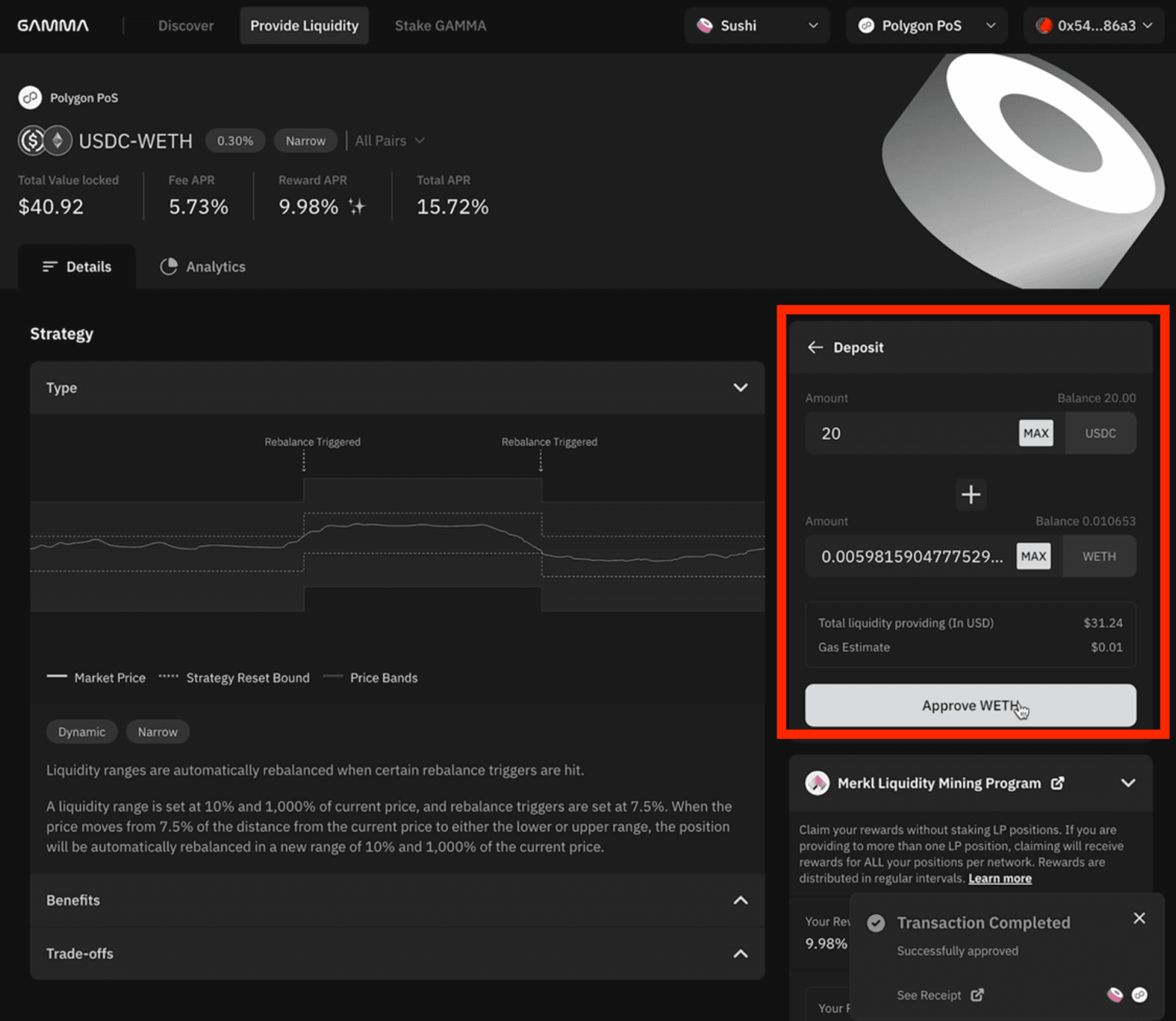

-6. Next, put the amount of both tokens with the same value you want to provide as liquidity. Then, approve the first token USDC to proceed with the deposit.

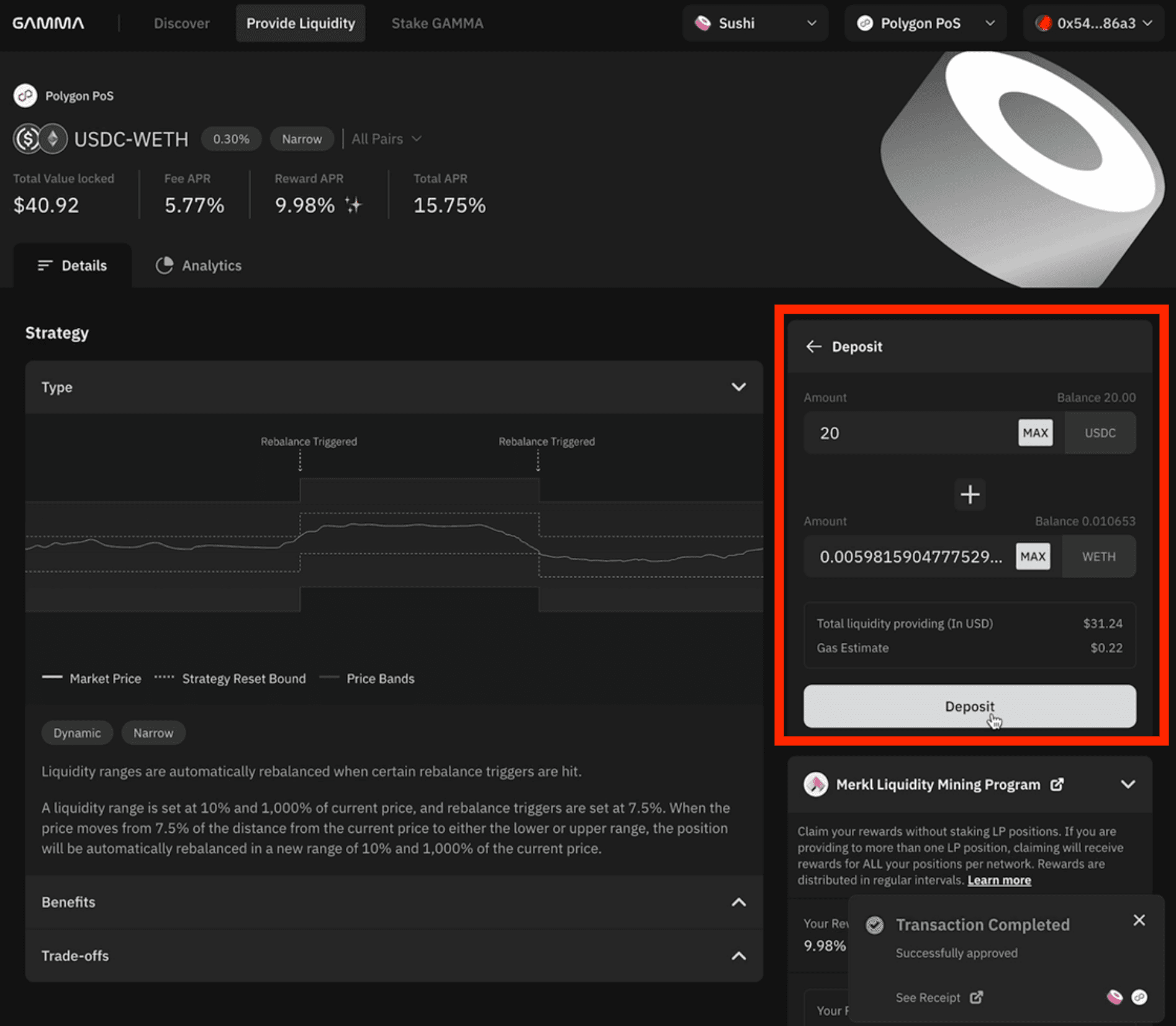

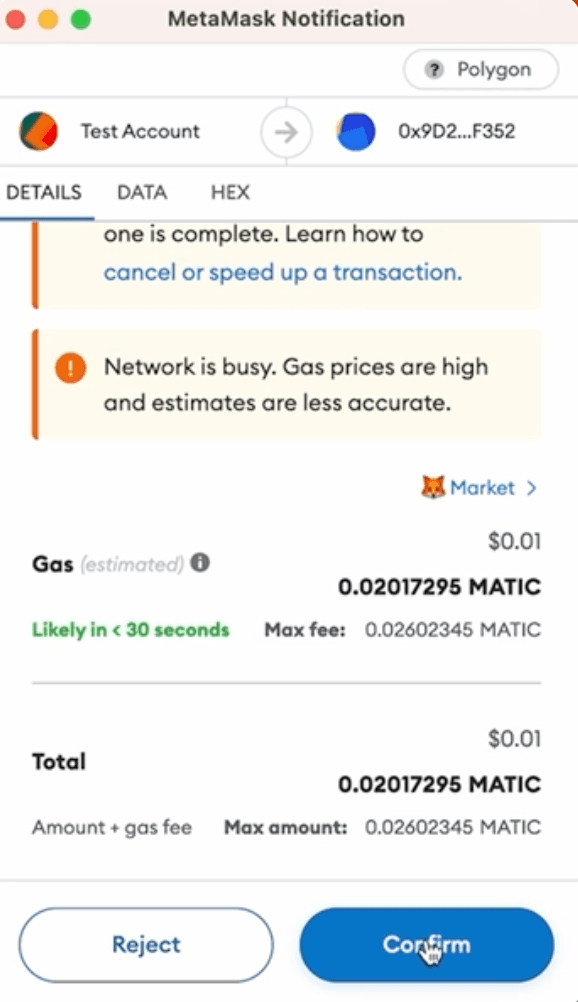

-7. Next, approve WETH and click on the "Deposit" button. Confirm the transactions on MetaMask.

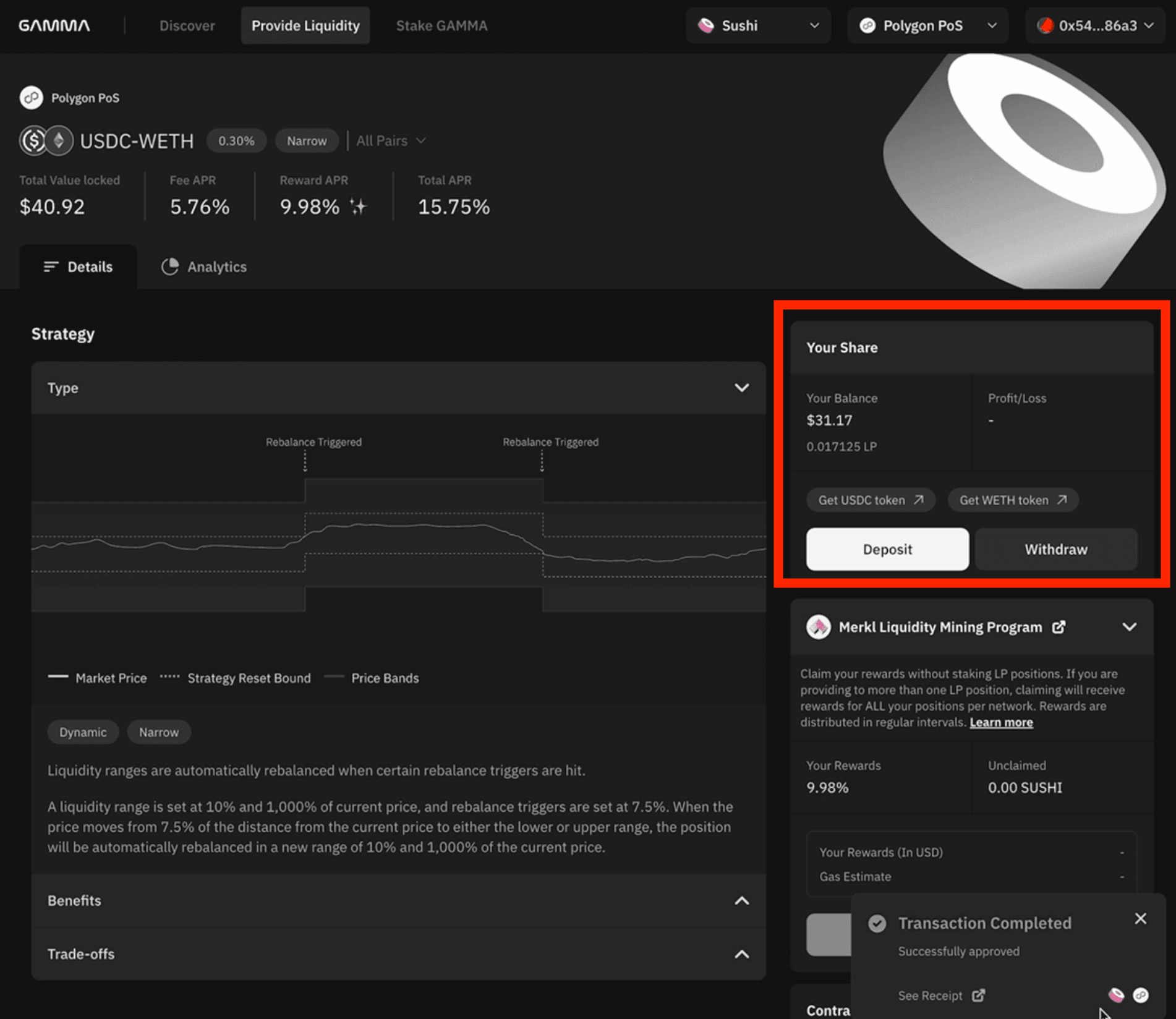

-8. Once the deposit is successful, your position will appear as "Your Share." Later on, you can claim your $SUSHI rewards without staking your LP positions by Merkl powered by the Angle Labs.

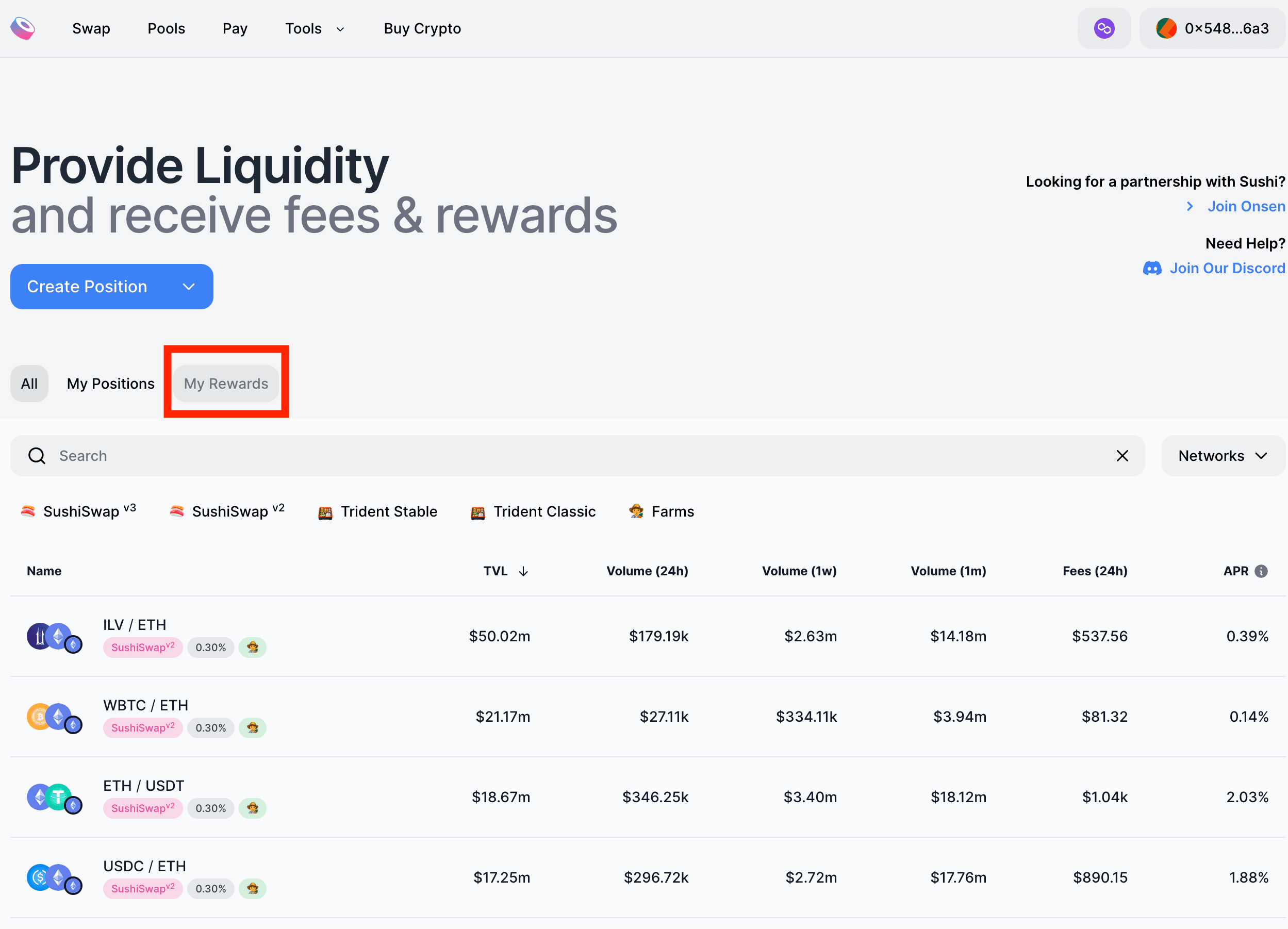

If you go back to Sushi, you can find your position under “My Rewards”

Closing

Hope the above helps! If you have any questions, please feel free to reach out on Discord or Twitter.

Experience Gamma with Sushi for smart strategies that offer higher profits and lower risks. Get started now!

Important Links:

- Gamma v2 Web App: http://app.gamma.xyz

- Sushi: https://sushi.com/

Sushi is building a comprehensive DeFi ecosystem! Follow our socials to keep up with our product launches and find out more on how you can make the most of your cryptocurrency assets with Sushi’s secure and powerful DeFi tools!

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github